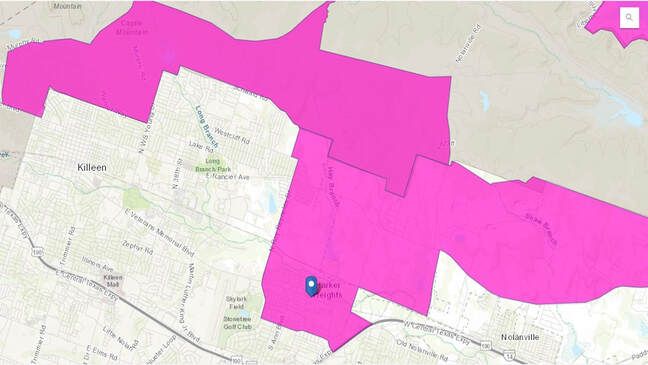

Harker Heights Opportunity Zones

Opportunity Zones are a new tool for community development. Established in the Tax Cuts and Jobs Act of 2017, Opportunity Zones provide tax incentives for investment in designated census tracts through qualified Opportunity Funds. Simply put, the incentive is for capital gains investments and offers a temporary deferral, a step up in basis (up to 15% if investment in Opp Fund is held for at least 7 years), and a permanent exclusion on gains accrued from the Opp Fund investment itself if held for at least 10 years.

The City of Harker Heights Opportunity zones

Additional Resources:

How Do Opportunity Zones Work?

Opportunity Zones FAQ

Investor Questions

HARKER HEIGHTS CHAMBER OF COMMERCE 552 EAST FM 2410, HARKER HEIGHTS, TX 76548 (254) 699-4999

This website uses marketing and tracking technologies. Opting out of this will opt you out of all cookies, except for those needed to run the website. Note that some products may not work as well without tracking cookies.

OPTOUT OF COOKIES

PA: 552 East FM 2410, Harker Heights, TX 76548

MA: 552 East FM 2410, Harker Heights, TX 76548